Skip the Trip to the Bank

A step-by-step guide to securely depositing a check by taking a picture with your phone.

Do you remember what it used to take to deposit a simple check? You had to find time in your day, drive to the bank, find parking, wait in line, and fill out a deposit slip, all for a two-minute transaction. It’s a process that can feel like a real chore. For many of us, this is still the routine.

But what if you could deposit that check from your living room at 9 PM on a Sunday, just by taking a picture? The good news is, you can. This technology is called Mobile Check Deposit, and it’s one of the most practical and secure features of modern online banking. Today, let’s walk through how it works, why it’s incredibly safe, and how you can do it yourself.

Online Banking Basics: “Deposit a Check Through Your Mobile Phone”

How Is This Possible? And Is It Safe?

This is the first and most important question. It can feel strange to trust a simple photo with your money. Here’s why it works and why banks not only allow it but encourage it:

It’s Highly Secure: When you take a picture in your bank’s official app, you are not just “sending a photo” like you would in an email. The app creates a private, encrypted tunnel directly to the bank’s secure servers. The check image is scrambled into a secret code, and it is never stored in your phone’s regular photo library.

It Prevents Fraud: This is the clever part. Banks have powerful systems that can instantly detect if the same check (based on its account number and check number) is being deposited a second time. More importantly, the special way you sign the back (which we’ll cover below) legally “voids” the paper check, preventing anyone from cashing it in person after it’s been deposited.

It’s a Win-Win: It makes life much easier for you, and it saves banks time and money in processing. It’s a true modern convenience.

Your Step-by-Step Guide to Depositing a Check

This process may vary slightly, but the core steps are the same for almost every bank app.

Step 1: Open Your Official Banking App

First, make sure you are using your bank’s official app (e.g., Chase, Bank of America, Wells Fargo, or your local credit union’s app) and are securely logged in.

Step 2: The Most Important Step! Endorse the Back

This is the crucial step for security. Before you do anything else, you must endorse the back of the check.

Sign your name in the endorsement area.

Under your signature, write the words “For Mobile Deposit Only.”

Some newer checks have a little checkbox that says, “Check here for mobile deposit.” If your check has this, check the box.

This step is mandatory. The bank’s computer will look for this text, and it will reject the deposit if it’s missing.

Step 3: Find the “Deposit” Button in Your App

Look for a button that says “Mobile Deposit,” “eDeposit,” “Deposit a Check,” or something similar.

Step 4: Enter the Check Amount

Your app will ask you to type in the exact dollar and cent amount of the check. This is an extra verification step to make sure the amount you type matches the amount on the check.

Step 5: Take the Photos

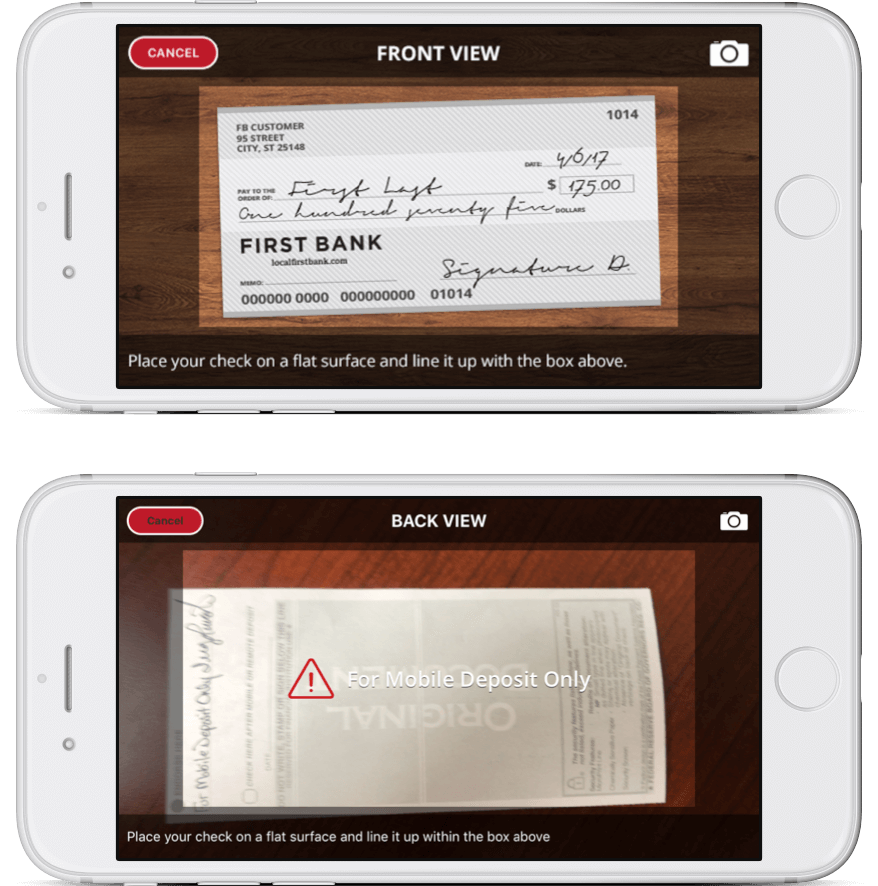

Your app will now open your camera.

Take a picture of the FRONT: Place the check on a flat, dark surface (like a dark wooden table) in a well-lit room. Hold your phone steady and center the check in the guidelines on your screen. The app will often detect the corners and snap the picture for you.

Take a picture of the BACK: Flip the check over (the side you signed) and do the same thing.

Step 6: Submit and Confirm

Tap the “Deposit” or “Submit” button. The app will review the images, and in a few seconds, it should give you a confirmation message that your deposit has been received.

And that’s it! You’ve just saved yourself a trip to the bank.

Quick Tech Tip: What to Do With the Paper Check?

Do not rip up the check right away! After you get the confirmation, take a pen and write “Mobile Deposited on [Today’s Date]” on the front of the paper check. Keep it in a safe place for a week or two, just until you see the funds officially clear your account. After that, you can shred it or destroy it.

Tech Term Demystified: ‘Encryption’

This is the term for the security that keeps your deposit safe. Encryption is the process of scrambling a message or file into a secret code. When your banking app sends your check image, it’s encrypted so that even if a hacker could intercept it, all they would see is meaningless, jumbled data. Only your bank has the special “key” to unscramble it and see the check.

Good News Byte

This technology has been a revolutionary tool for accessibility. For people who have mobility challenges, live in rural areas far from a bank branch, or have schedules that make it difficult to get to the bank during its open hours, mobile deposit provides true financial independence. It ensures that everyone has the same convenient access to their money, right from their own home.

Did You Know?

This entire system was made possible by a law passed in 2003 called the “Check Clearing for the 21st Century Act” (or “Check 21”). After the 9/11 attacks, all air travel in the U.S. was grounded, which brought the nation’s banking system to a halt because banks couldn’t physically fly paper checks between cities for processing. This law was passed to give a digital image of a check the same legal standing as the original paper, paving the way for the remote and mobile deposit technology we all use today.

Your Turn to Take the First Step!

This week, you don’t even have to deposit a check. Just try this: log in to your bank’s mobile app and look for the “Mobile Deposit” button. Just find it. See what the screen looks like. Getting familiar with where the tool is located is the perfect first step to feeling comfortable with this amazing time-saver.

Wishing you a week of no lines at the bank,

Steve