Understanding Venmo

Learn what Venmo is, how it works, and why it's a secure way to pay people you trust.

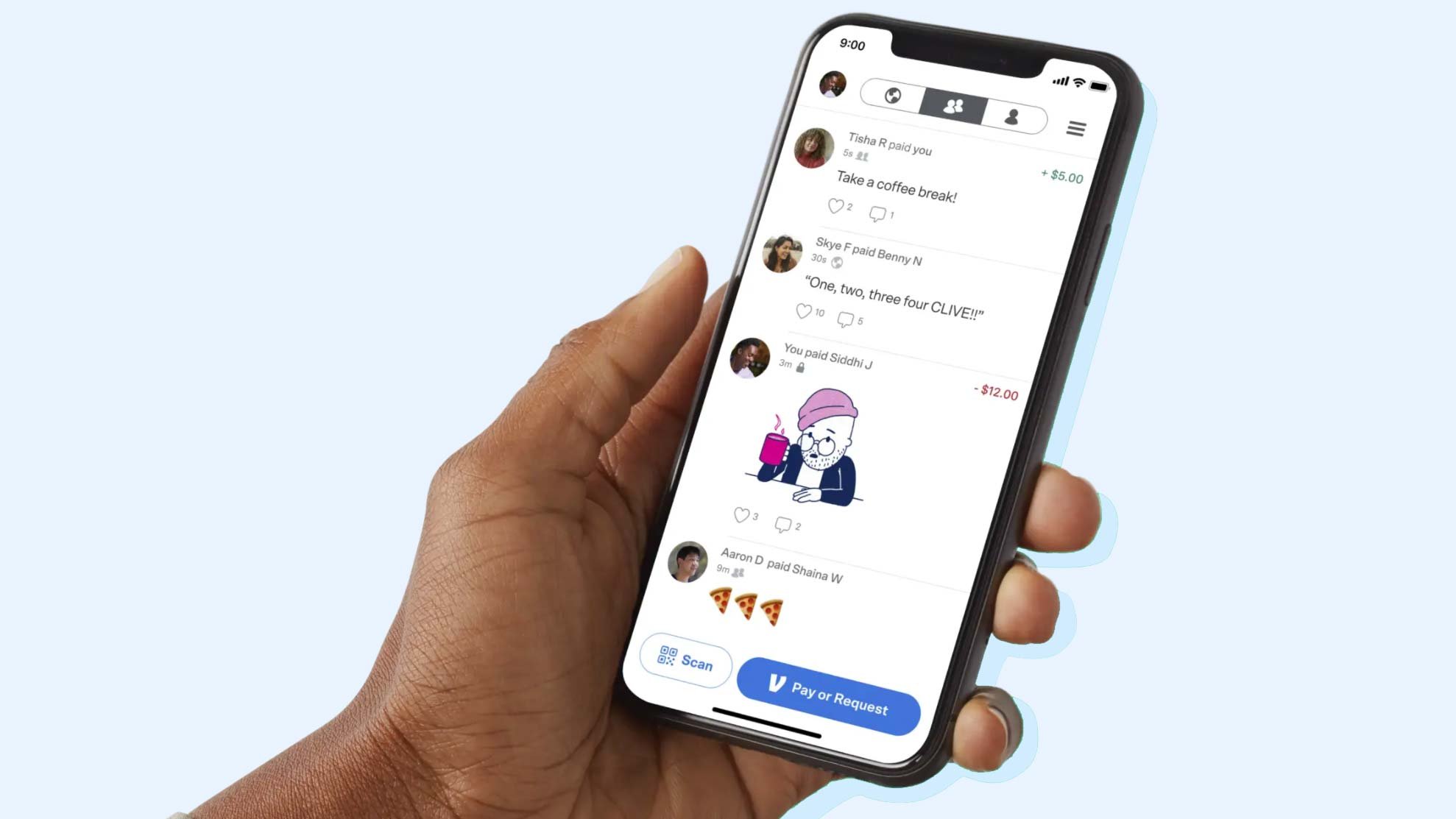

Welcome back to our “Tech Explainer” series, where we demystify the modern apps and websites you’ve likely heard about. Today, we’re tackling a big one. Have you ever been out to dinner with your family, and when the check comes, you hear your kids or grandkids say, “Don’t worry, I’ll just Venmo you for my share”?

If you’ve ever found yourself wondering what this “Venmo” is, you’re not alone. It can sound like a strange, abstract concept, but it’s actually just a modern, digital solution to a very old task: handing money to people you know. Our goal today isn’t to get you to use it, but to explain what it is, why it’s so popular, and how it’s kept safe.

Tech Explainer #6: A Guide to Understanding Venmo

So, What is Venmo?

At its simplest, Venmo is a free app for your smartphone that acts like a digital wallet or a digital checkbook. It’s designed to let you easily pay or receive money from people you know and trust, like friends, family, or a babysitter.

You might be relieved to know that Venmo is not some brand-new, unproven company. It is owned by PayPal, a company that has been a trusted leader in secure online payments for over 25 years.

How Does It Work?

The process is surprisingly straightforward.

The Setup: You download the free Venmo app onto your smartphone. During setup, you securely link your bank account or a debit card to your Venmo account. (This is a highly secure, one-time process, just like linking your bank account to pay a utility bill online).

Paying Someone: To pay someone, you open the app, find your friend by their unique username (or their phone number), type in the amount (e.g., “$20”), write a short note (like “For my share of lunch!”), and tap “Pay.”

Receiving Money: When someone pays you, the money appears in your “Venmo balance” within the app. You can then leave that money in your balance to pay someone else later, or you can transfer it out to your linked bank account. The standard transfer is free and usually takes 1-3 business days.

Who Uses It and Why Might You Use It?

Venmo is extremely popular with younger generations for splitting everyday expenses like dinner bills, movie tickets, or rent. But it has many practical uses for everyone:

Sending Birthday Money: It’s the modern version of putting a $20 bill in a birthday card. You can instantly send birthday or graduation money to a grandchild, and they’ll receive it right away, no matter where they are.

Splitting a Lunch Bill: You’re out with a group of friends, and one person pays the full bill to make it easy. You can all pull out your phones and Venmo them your $15 share right from the table. No one has to “get change for a fifty” or worry about “I’ll pay you back later.”

Paying for Small Services: It’s a perfect way to pay the neighborhood kid who mows your lawn, the babysitter who watched the grandkids, or the person you bought something from at a local craft fair.

The Big Questions: Is It Safe and Secure?

This is the most important question, and the answer is yes. Venmo is built with multiple layers of security, just like your online bank.

Bank-Level Encryption: Venmo uses encryption to protect your account details, meaning your bank information is scrambled and kept private from everyone, including the person you are paying.

App Security: You can (and should) set up a PIN code, as well as a fingerprint or Face ID, just to open the app. This means even if someone were to get ahold of your unlocked phone, they couldn’t open Venmo to send money.

Fraud Monitoring: Just like your credit card, Venmo’s systems monitor your account for suspicious activity and will flag transactions that seem unusual.

But What About Privacy? (This is Important!)

By default, Venmo has a “social feed” where your friends can see the notes for your transactions (never the dollar amount). This is the part that feels strange to many people. I’ve always thought this was a pretty crazy feature, but some people love it. The good news is, you can make all of your transactions completely private.

In the app’s Settings, under “Privacy,” you can select “Private” for all your future transactions. This ensures that no one but you and the person you are paying can see the transaction. I highly recommend this setting if you try it out.

Quick Tech Tip

A key thing to remember is that Venmo is designed for people who know and trust each other. It’s like handing someone cash. You wouldn’t hand $50 to a stranger on the street for a promise, and you shouldn’t use Venmo to buy something from a stranger on the internet. It’s for friends, family, and people you know.

Tech Term Demystified: ‘Peer-to-Peer (P2P) Payment’

You’ll see this term, “P2P,” a lot. It stands for “Peer-to-Peer” (or “Person-to-Person”) and it simply means a technology that lets two regular people (”peers”) exchange money directly with each other, without needing a traditional bank or store to act as the middleman. Venmo is one of the most popular P2P apps.

Did You Know?

The name “Venmo” comes from a combination of two words: vendere, the Latin word for “to sell,” and “mo,” short for “mobile.” When the founder first created it, he wanted a simple way to “sell” things to friends from his mobile phone, and the name stuck!

Your Turn to Start a Conversation!

You don’t need to download the app today. But the next time you’re with your kids or grandkids and the topic of paying for something comes up, ask them to show you how Venmo works on their phone. You’ll see that, behind the strange name, it’s just a simple, secure, and very handy tool for a task as old as time.

Wishing you a week of simple transactions,

Steve